**You’ll Never Believe What Loans Are Changing Home Renovations Forever** Home remodeling is no longer just about paint and flooring—it’s becoming a strategic financial shift that’s quietly reshaping how Americans improve their living spaces. What’s truly surprising? The new loans available today are unlocking opportunities most homeowners never assumed possible. You’ll never believe what loans are changing home renovations forever—not just in cost or access, but in how they unlock long-term value, financial flexibility, and peace of mind. In recent years, shifting economic realities, evolving lending standards, and innovative financing tools have collided to transform home renovation funding. What was once seen as a costly, risky investment is now accessible for a broader audience—thanks in part to loan products designed specifically for renovation needs. These loans aren’t just about cash upfront; they’re reshaping the relationship between home improvement, debt management, and sustainable living. ### Why You’ll Never Believe What Loans Are Changing Home Renovations Forever Across the U.S., more homeowners are realizing that timid renovation stays behind due to confusing financing. But a growing number now recognize that strategic loans can turn costly delays into confident upgrades—whether fixing a leaky roof, expanding space, or boosting energy efficiency. The rise of flexible financing options is reducing barriers, making high-impact renovations feasible even for those who thought they couldn’t qualify. This shift reflects broader trends in financial inclusion and homeownership empowerment, especially among first-time builders and aging homeowners looking to modernize safely.

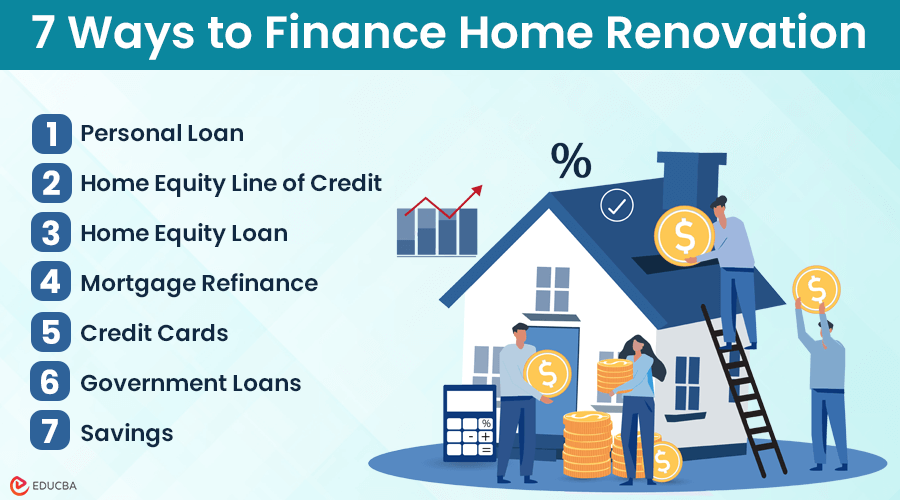

### How You’ll Never Believe What Loans Are Changing Home Renovations Forever Actually Works These loans aren’t magic—they’re designed solutions based on real financial principles. Most function as construction loans or home equity lines, tailored specifically to fund renovation projects. Typically, they offer flexible repayment tied to project milestones, allowing borrowers to pay off funds as work progresses. This minimizes immediate strain and aligns payments with income or renovation completion. Some programs combine low-interest rates with longer tenures, reducing monthly burdens while keeping total borrowing affordable. Borrowers often strengthen debt-to-income ratios by using committed funds exclusively for permitted renovations, avoiding unnecessary credit expansion. The process usually requires clear project plans, budget estimates, and even contractor certification—ensuring transparency and accountability. Importantly, these loans don’t lead to financial risk when managed responsibly. With proper planning, many homeowners see renovations improve property value, reduce long-term maintenance costs, and boost comfort—making the investment more than just aesthetic. ### Common Questions People Have About You’ll Never Believe What Loans Are Changing Home Renovations Forever **How do I qualify for one of these loans?** Eligibility depends on factors like credit history, income stability, and project type. Most lenders prioritize proof of income, a clear renovation plan, and a manageable debt capacity. No single “magic score” opens doors—clear preparation increases approval odds. **Are these loans risky?** Like any debt, they carry responsibility. The key is transparency and purpose. Loans tied strictly to authorized renovations, with realistic terms, reduce risk. Responsible borrowing paired with accurate estimates keeps finances in check. **Can I combine loans or refinance?** Yes. Many borrowers combine loans with existing mortgages or use refinancing to secure better rates mid-project. Clear communication with lenders helps avoid pitfalls and maintains financial clarity. ### Opportunities and Considerations **Pros:** Controlled access to affordable funding, expanded renovation possibilities, improved energy efficiency, and potential value gains. **Cons:** Requires careful planning and realistic budgeting, potential impact on credit if mismanaged, complex terms needing clear understanding. Not all loans are created equal—conditions vary by lender, project scope, and borrower profile. Choosing the right option demands research and honesty about financial capacity. **What People Often Misunderstand** - **Myth:** These loans are only for luxury upgrades. Reality: Many fund essential repairs, energy retrofits, and senior-accessible modifications that improve safety and longevity. - **Myth:** All are high-risk or predatory. Fact: Reputable lenders offer transparent terms, fixed rates, and support to prevent over-borrowing. - **Myth:** You’ll max your credit just for renovations. Clarification: Responsible use keeps borrowing within sustainable limits, often paired with consistent income and good credit habits.

Not all loans are created equal—conditions vary by lender, project scope, and borrower profile. Choosing the right option demands research and honesty about financial capacity. **What People Often Misunderstand** - **Myth:** These loans are only for luxury upgrades. Reality: Many fund essential repairs, energy retrofits, and senior-accessible modifications that improve safety and longevity. - **Myth:** All are high-risk or predatory. Fact: Reputable lenders offer transparent terms, fixed rates, and support to prevent over-borrowing. - **Myth:** You’ll max your credit just for renovations. Clarification: Responsible use keeps borrowing within sustainable limits, often paired with consistent income and good credit habits. ### Who You’ll Never Believe What Loans Are Changing Home Renovations Forever May Be Relevant For This shift affects homeowners renovating for first-time income, downsizing safely, improving accessibility, or upgrading aging housing stock. Young families seeking让自己 home offices or accessibility features benefit deeply. Retirees modernizing outdated homes without selling gain confidence in structured debt. Even dream homebuilders discovering scalable, affordable entry points find these loans a quiet game-changer. The truth is, home improvement isn’t out of reach—it’s evolving. With the right loan, renovation becomes not just manageable, but a forward-thinking investment in comfort, safety, and value. ### Soft CTA Ready to explore how smarter financing could transform your next renovation project? Start by reviewing your current budget, research lender options tailored to your goals, and consult a financial advisor—no pressure, just informed steps forward. The ceiling is lower than you think—and the right loan might just raise the room. Home renovation is evolving. What you’ll never believe is how accessible, responsible, and rewarding the future of funding these changes truly is.

### Who You’ll Never Believe What Loans Are Changing Home Renovations Forever May Be Relevant For This shift affects homeowners renovating for first-time income, downsizing safely, improving accessibility, or upgrading aging housing stock. Young families seeking让自己 home offices or accessibility features benefit deeply. Retirees modernizing outdated homes without selling gain confidence in structured debt. Even dream homebuilders discovering scalable, affordable entry points find these loans a quiet game-changer. The truth is, home improvement isn’t out of reach—it’s evolving. With the right loan, renovation becomes not just manageable, but a forward-thinking investment in comfort, safety, and value. ### Soft CTA Ready to explore how smarter financing could transform your next renovation project? Start by reviewing your current budget, research lender options tailored to your goals, and consult a financial advisor—no pressure, just informed steps forward. The ceiling is lower than you think—and the right loan might just raise the room. Home renovation is evolving. What you’ll never believe is how accessible, responsible, and rewarding the future of funding these changes truly is.

Shocked When I Tried the Highest Protein Breakfast That Changed My Whole Day!

Discover the Shocking Truth: Hidden Costs of Health Insurance in NYC

Secret Hair Color Men Secretly Cant Live Without Locked Behind Confidence!